The Gold Loan Wizardry ⭐️

Up I win. Down you lose!

That there is goal every business envisions of. The holy grail every investment guide prompts you to seek. An investment that is all-weather proof, or what Taleb refers to as “Anti-Fragile”. A business not just unshaken by worldly catastrophes but one that benefits from chaos. Several books, charts and years later, I couldn’t unsee the beauty embedded in the business of Gold Loans. 🤴🏽

As defined by Cibil, Gold Loans are secured loans taken by a borrower from a lender by pledging their gold articles as collateral. The loan amount provided is a certain percentage of the gold, typically upto 90%, based on the current market value and quality of gold.

To put it simply, an individual requiring a loan can use the gold (asset) he owns (coins, jewellery, artefacts) as collateral to secure a loan. This is very similar to obtaining a home loan, where the lender, usually a bank, can impose its rights on the house (asset) if the borrower fails to repay the instalments. Generally, a borrower can get a loan of upto Rs.90 on depositing gold worth Rs.100 (10% haircut), since the lender also cushions itself against a fall in gold prices.The borrower subsequently regains possession of his gold once the loan is repaid.

Hmmm, ok. Just like any other loan. What’s so special Deven? 🤷🏼♂️

Well, hang on with me! Let’s analyse 2 scenarios - Up and Down. 🧠

The Up 🟢 is intuitively simple. When economies do well, people borrow money to grow their businesses and repay once profits bloom. The bankers, borrowers, customers and even the government is happy with this transaction.

The contrary, Down 🔴, is where most businesses suffer, investors lose money and banks deal with ceaseless NPAs. Businesses fail to deliver expected profits, and therefore the borrowers are a risk of being unable to return the funds. The bank’s only hope of recovering the lost money is the collateral, in this case THE GOLD. ⭐️

Gold has been a safe-haven asset throughout history. This means, when the world goes into chaos, investors sell bonds and equities and move their money into gold.

Why?

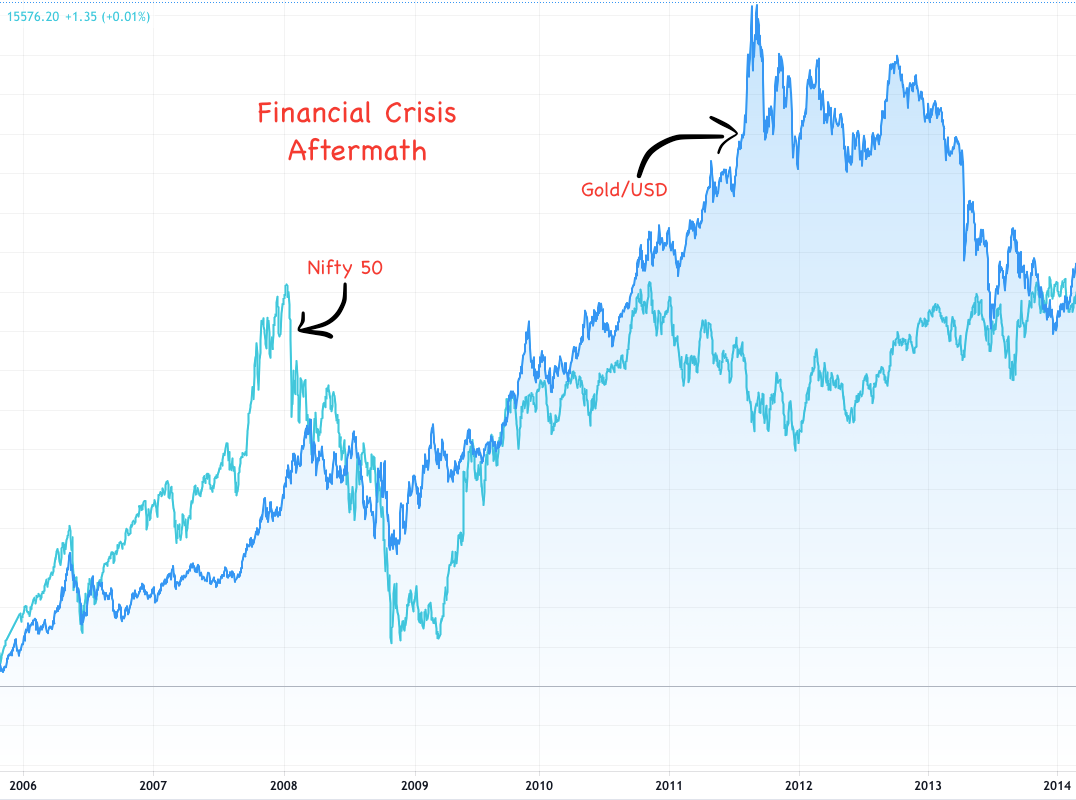

Because gold is not prone to government or corporate defaults, economic disasters or inflation. With a spike in demand, and relatively constant supply, gold prices rocket. In fact, gold which is positively correlated to the Nifty 50 (corr = 0 - 0.5) during bull-runs, suddenly becomes uncorrelated or negatively correlated during economic downfalls.

A graph of the returns on gold vs the Nifty 50 speaks for itself.

Incase of such defaults, the skyrocketing prices of gold provide a natural cushion to the lender. The price of gold has historically rallied between 20%-40% post each recessionary period. The lender advantageously is holding gold worth Rs.120-140 for a loan worth Rs.90. This instinctively prevents any major losses in the books of the gold loan provider. 🔥 Additionally, in a country like India, where the woman’s jewellery is a matter of pride, “ghar ke zewar” are never given up on! 👑

Due to the embedded tactical advantages and beauty in the business model, leading gold loan companies have become a gold mine for investors who stand to benefit from the shrewd execution of the managers and the anti fragile nature of the business.

No wonder, Deven, Muthoot Finance, the leading gold based lender in the country has clocked a CAGR of over 40% for the last 5 years.

Of course, a lot of other variables such as RBI policy stance, competitive landscape, financials and management strategies play a vital role in determining whether a company is a good investment.

Disclaimer: Not invested in Gold or Gold Finance Companies

DM 🚀

At Moonstocks, I write to provide interesting yet simplified insights about personal finance and investing so that you don’t feel left out during those money discussions! Incase you haven't already subscribed, hit that button!